Charts are informative and widely adopted in Business Intelligence. However, sometime they are misused and generates no business insights but confusion. In my last post, we've discussed about Line Chart and Pie Chart. Today let's continue the same topic by examining map, gauge and Trellis.

Gauge is normally used to show a single data value of key performance indicators (KPIs). Due to its compact size, a gauge is often more effective than a graph for displaying a single data value. Gauges identify problems in data. A gauge usually plots one data point with an indication of whether that point falls in an acceptable or unacceptable range. Thus, gauges are useful for showing performance against goals.

Depending on the data in the analysis, a gauge view might consist of multiple gauges in a gauge set. For example, if you create a gauge view to show the sales data for the last twelve months, the gauge view consists of twelve gauges, one for each month. If you create one to show the total sales in the US, then the gauge view consists of one gauge.

It is often helpful to divide the data set we wish to examine into multiple graphs, either because we can't display everything in a single graph without restoring to a 3D display, which would be difficult to decipher, or because placing all the information in a single graph would make it too cluttered to read. By splitting the data into multiple graphs that appears on the screen at the same time in close proximity to one another, we can examine the data in any one graph more easily, and we can compare values and patterns among graphs with relative ease. This is referred by people as Trellis Chart.

The trellis chart, which was introduced in recent OBIEE 11.1.1.6.2 BP1 release, is the same as a pivot table—with one major exception: the data cells within the trellis contain graphs. Whereas a stand-alone graph type such as a single bar graph or a single scatter graph works on its own, the trellis graph works only by displaying a grid of nested graphs, known as inner graphs. So a bar-graph trellis view is actually comprised of multiple bar graphs.

Let's have a look at an example. We need to analyze the trend of monthly net cost of sale by product by region. Giving only 8 different offices and 4 products, we will will have the combination 32 lines stretching along the X-axis of time dimension. Obviously the chart will be too dense to read if everything is placed on one graph. But even if we break it into sections by products, we will end up with 4 clumsy line charts which won't be fit on one web page and not very readable individually.

Map Chart

Maps have been used to visualize information since the early phase of human civilization. Now in the recent years, thanks to the digitalization of maps more and more quantitative analysis of location related information can be performed on top of map. Furthermore, with powerful spatial systems such as Oracle Spatial, the business intelligence users can bring the spatial analysis to another higher level by invoking advance spatial functions such as topological operators or distance operators. In one of my previous posts, I briefly went through how spatial analysis can be achieved with OBIEE's integration with Oracle MapViewer, Oracle Spatial and digital map services such as Navteq or Google.

However, just because you can now display quantitative data on a map doesn't mean you should in every case. the location of something or its proximity to something else is not always useful information for analysis. But in some cases, it is critical to display data on a map.

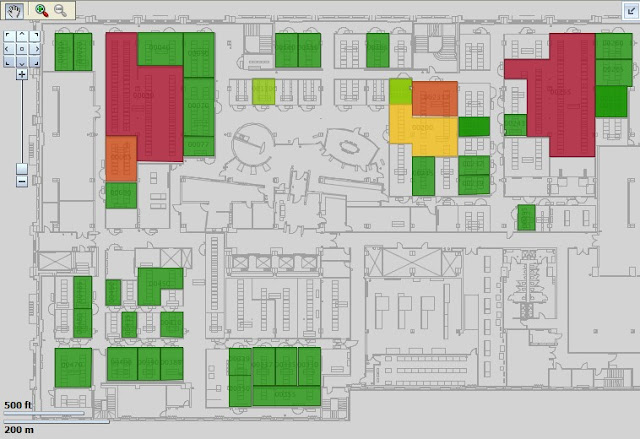

In the example below, we color coat sales volume for individual stores on a floor-plan map. Intuitively, the correlations between store value and environment factors are revealed. How significantly is a food court attracting customers for stores nearby? Is it true that shops next to lifts will always have more customer visits than those far from lifts? Is that necessary to have baby feeding room on each floor of the shopping mall? With conventional views such as pivot table or bar chart, none of these can be easily presented.

In contrast, placing pie chart to indicate the state of sales for different products in regions on a map of the United States as shown in the next example adds no value. Firstly it's nearly impossible to tell the differences between products on a tiny pie chart, secondly a simple table with sales group by product and region would have provided the information more directly.

However, just because you can now display quantitative data on a map doesn't mean you should in every case. the location of something or its proximity to something else is not always useful information for analysis. But in some cases, it is critical to display data on a map.

In the example below, we color coat sales volume for individual stores on a floor-plan map. Intuitively, the correlations between store value and environment factors are revealed. How significantly is a food court attracting customers for stores nearby? Is it true that shops next to lifts will always have more customer visits than those far from lifts? Is that necessary to have baby feeding room on each floor of the shopping mall? With conventional views such as pivot table or bar chart, none of these can be easily presented.

|

| Business Intelligence on Floorplan |

In contrast, placing pie chart to indicate the state of sales for different products in regions on a map of the United States as shown in the next example adds no value. Firstly it's nearly impossible to tell the differences between products on a tiny pie chart, secondly a simple table with sales group by product and region would have provided the information more directly.

|

| Pie chart is not helpful on Map |

Gauge Chart

Depending on the data in the analysis, a gauge view might consist of multiple gauges in a gauge set. For example, if you create a gauge view to show the sales data for the last twelve months, the gauge view consists of twelve gauges, one for each month. If you create one to show the total sales in the US, then the gauge view consists of one gauge.

However, if the objective is not for comparing against goal that's broken down into ranges, but for seeing the precise differences between values, Bar Chart is still a better choice.

Trellis Chart

The trellis chart, which was introduced in recent OBIEE 11.1.1.6.2 BP1 release, is the same as a pivot table—with one major exception: the data cells within the trellis contain graphs. Whereas a stand-alone graph type such as a single bar graph or a single scatter graph works on its own, the trellis graph works only by displaying a grid of nested graphs, known as inner graphs. So a bar-graph trellis view is actually comprised of multiple bar graphs.

Let's have a look at an example. We need to analyze the trend of monthly net cost of sale by product by region. Giving only 8 different offices and 4 products, we will will have the combination 32 lines stretching along the X-axis of time dimension. Obviously the chart will be too dense to read if everything is placed on one graph. But even if we break it into sections by products, we will end up with 4 clumsy line charts which won't be fit on one web page and not very readable individually.

|

| Information overflowing on line chart |

On the other hand, if we use Trellis Chart to present the same amount of information, by separating each region and product, we can now compare the correlation pattern formed by each group and more easily spot the differences. Trend lines for net sale costs for 18 months, 8 offices and 4 products are clearly visualized on one pivot table which can be examined by users with no scrolling through multiple pages.

|

| Trellis Chart |

In summary, the ultimate objective of BI visualization is for helping people to see, understand and digest information. As data visualization tool, graphical charts will only fulfill their functionalists if you can choose them wisely for different underlying data and business purposes.